Garage Tax: Understanding the Costs and Implications

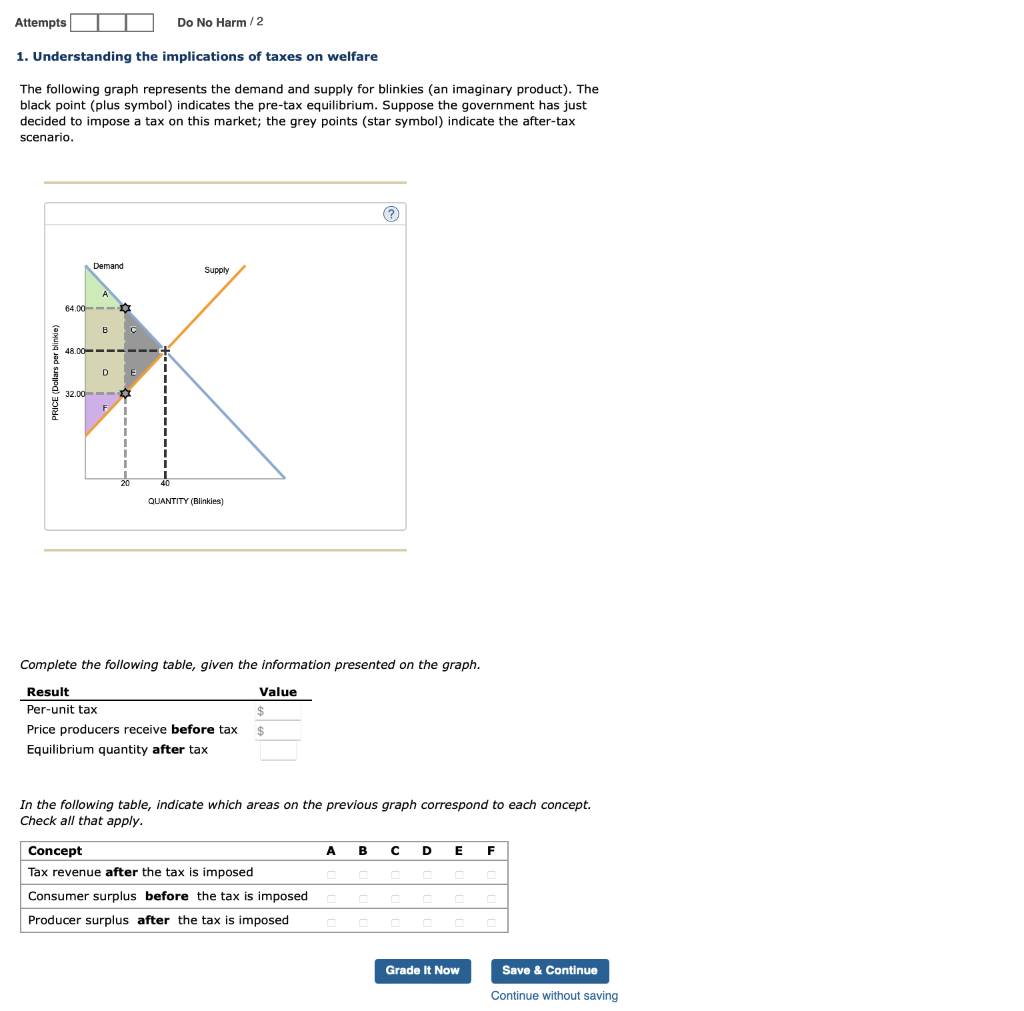

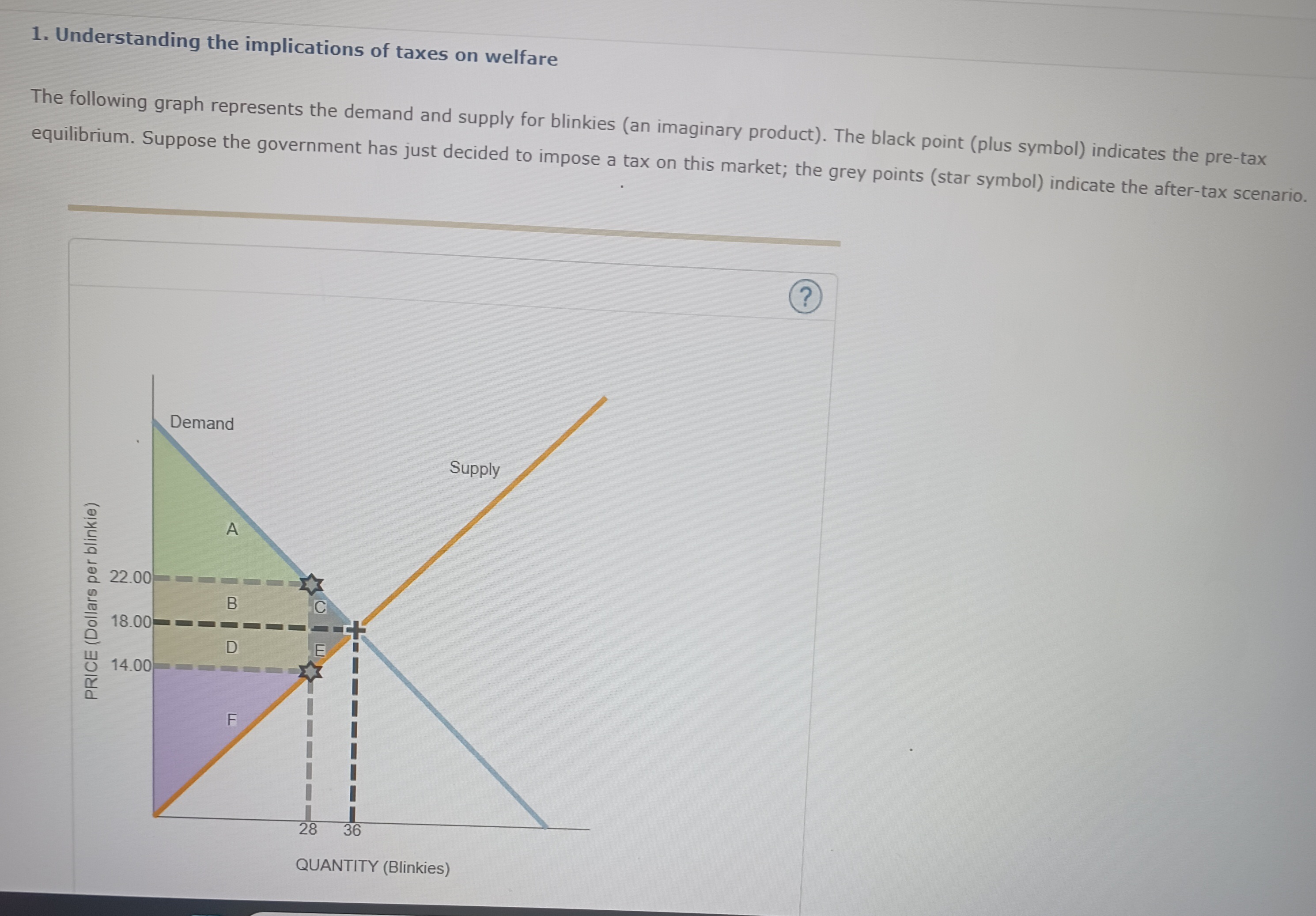

Solved 1. Understanding the implications of taxes on welfare | Chegg.com - Source www.chegg.com

Editors' Notes: "Garage Tax: Understanding the Costs and Implications" have published today date". This topic is important to read because it provides valuable insights into the potential costs and implications of garage taxes.

Our team has done extensive research and analysis to compile this guide, which will help you understand the key issues surrounding garage taxes. The guide covers topics such as the different types of garage taxes, the costs associated with these taxes, and the potential impact on your property value.

Key Differences or Key Takeaways

| Type of Garage Tax | Cost | Impact on Property Value |

|---|---|---|

| Annual Tax | Varies depending on municipality | Minimal impact |

| Square Footage Tax | Based on the square footage of the garage | Can have a significant impact |

| Value-Based Tax | Based on the estimated value of the garage | Can have a significant impact |

Transition to Main Article Topics

FAQ

The Garage Tax: Understanding the Costs and Implications. In this section, we delve into the specific costs and potential implications associated with the garage tax.

Understanding The Tax Implications Of Car Title Transfers - MVD Express - Source www.mvdexpress.com

Question 1: What is the Garage Tax?

The Garage Tax refers to the practice of imposing property taxes on vehicles stored within a garage or other enclosed space on a residential property. These taxes are levied by local governments as a means of generating revenue.

Question 2: How is the Garage Tax Calculated?

The calculation of the Garage Tax varies depending on the jurisdiction. In general, the tax is based on the assessed value of the vehicle, which is determined by its make, model, year, and condition.

Question 3: What are the Implications of Not Paying the Garage Tax?

Failure to pay the Garage Tax can result in penalties, including fines and potential legal action. Additionally, the unpaid taxes may accrue interest, further increasing the financial burden.

Question 4: How Can I Avoid or Reduce the Garage Tax?

Some jurisdictions offer exemptions or reduced rates for certain types of vehicles, such as those used for business purposes or those owned by disabled individuals. Additionally, homeowners may consider storing vehicles in driveways or other non-enclosed spaces to avoid the tax.

Question 5: Is the Garage Tax Fair?

The fairness of the Garage Tax is a matter of ongoing debate. Some argue that it is a reasonable way to generate revenue for local governments, while others view it as an unfair burden on homeowners.

Question 6: What Are the Long-Term Implications of the Garage Tax?

The long-term implications of the Garage Tax are still being debated. Some experts believe that it could lead to a decline in property values and a reduction in the number of vehicles owned by homeowners.

Understanding the Garage Tax is crucial for homeowners and policymakers alike. By addressing the common questions and concerns surrounding this issue, we can make informed decisions regarding its implementation and potential impact.

Next Article Section:

Tips

The Garage Tax can have a significant impact on homeowners and businesses. Understanding the costs and implications of this tax is crucial to make informed decisions. Here are some tips to help navigate the complexities of the Garage Tax:

Understanding Tax - SMEinfo Portal - Source www.smeinfo.com.my

Tip 1: Determine if the Garage Tax applies to you

The Garage Tax is typically levied on non-residential properties, such as commercial buildings, rental properties, and vacant lots. However, some municipalities may extend the tax to residential properties as well. Check with your local tax authority to determine if the Garage Tax applies to your property.Garage Tax: Understanding The Costs And Implications

Tip 2: Calculate the potential tax liability

The Garage Tax is usually assessed based on the square footage of the garage or the value of the property. Contact your local tax assessor to obtain the specific tax rate and calculate your potential tax liability.

Tip 3: Explore tax deductions and exemptions

Some municipalities offer tax deductions or exemptions for certain types of garages, such as those used for agriculture or storage. Explore these options to reduce your tax bill.

Tip 4: Consider the impact on property value

The Garage Tax can affect the value of your property. The presence of a large, taxable garage may lower the property's overall value, while a smaller, non-taxable garage may increase it.

Tip 5: Consult with a tax professional

Navigating the Garage Tax can be complex. Consulting with a tax professional can help you understand the specific requirements and implications for your property, ensuring you comply with the regulations and minimize your tax liability.

By following these tips, you can gain a better understanding of the Garage Tax and make informed decisions to manage its impact on your finances and property.

For more information and professional guidance, consider consulting a reputable tax professional or referring to the resources provided by your local tax authority.

Garage Tax: Understanding The Costs And Implications

Garage tax, a nuanced topic, encompasses various facets that warrant exploration, from financial implications to broader societal impacts. Understanding these essential aspects is crucial for informed decision-making.

- Financial Impact: Assessing the direct and indirect costs associated with garage tax, including increased property taxes and reduced property values.

- Economic Implications: Analyzing the potential impact on local economies, including job creation and business development.

- Environmental Considerations: Exploring the environmental implications of reduced parking availability, including increased traffic congestion and air pollution.

- Urban Planning: Examining the role of garage tax in shaping urban planning decisions, such as land use allocation and transportation infrastructure.

- Social Equity: Investigating the potential regressivity of garage tax, particularly its impact on low-income and marginalized communities.

- Policy Implications: Reviewing existing policies and exploring alternative approaches to address the challenges posed by garage tax.

These aspects are interconnected and collectively form a complex issue. The financial implications, for instance, can have ripple effects on local economies and urban planning decisions. Similarly, environmental considerations must be balanced against economic needs and social equity concerns. By examining these key aspects, a comprehensive understanding of garage tax and its multifaceted implications can be achieved.

LTCG tax : An overview - Source aryanlandmark.com

Garage Tax: Understanding The Costs And Implications

Garage tax, also known as a parking tax, is a fee imposed on property owners who park vehicles on their property. The tax is typically levied by local governments and can vary widely in amount. Garage taxes can have a significant impact on property owners, both financially and practically.

Solved 1. Understanding the implications of taxes on welfare | Chegg.com - Source www.chegg.com

One of the most significant costs of garage tax is the financial burden it can place on property owners. The tax can add hundreds or even thousands of dollars to the annual cost of owning a home. This can be a significant expense for many homeowners, especially those on a tight budget.

In addition to the financial costs, garage tax can also have a number of practical implications. For example, the tax can make it more difficult for homeowners to sell their property. Potential buyers may be deterred by the additional cost of the garage tax, and the tax can also lower the value of the property.

Conclusion

Garage tax is a significant issue that can have a major impact on property owners. The tax can be a financial burden, and it can also make it more difficult to sell a property. Homeowners who are considering purchasing a property in an area with a garage tax should be aware of the potential costs and implications.

In recent years, there has been a growing movement to repeal garage taxes. A number of states and municipalities have already done so, and others are considering following suit. If you are a homeowner who is opposed to garage tax, you can contact your local officials and let them know your concerns.