Delving into the Fundamentals of the Euro Interbank Offered Rate (Euribor): A Comprehensive Guide

Euribor is the Euro Interbank Offered Rate by European Central Bank - Source www.dreamstime.com

Editor's Note: Unveiling The Euribor: A Comprehensive Guide To The Euro Interbank Offered Rate has been published today (March 8, 2023). Understanding the significance of the Euribor is crucial for various industry sectors, including finance, economics, and international trade. This guide aims to provide a clear and detailed examination of the Euribor, its calculation methodology, and its impact on financial markets.

Through extensive analysis and research, we have compiled this comprehensive guide to empower our readers with a thorough understanding of the Euribor. By delving into its intricacies, individuals can make informed decisions and navigate the complexities of the financial landscape with greater confidence.

Key Differences or Key Takeaways

| Feature | Key Difference |

|---|---|

| Calculation Methodology | Based on daily submissions from a panel of leading eurozone banks, reflecting the average interest rate at which banks lend to each other. |

| Benchmark Importance | Serves as a reference rate for various financial instruments, including loans, bonds, and derivatives. |

| Economic Impact | Influences the cost of borrowing and lending, impacting economic growth and inflation. |

Transition to Main Article Topics

FAQ

This comprehensive FAQ section provides clear and concise answers to frequently asked questions about the Euro Interbank Offered Rate (Euribor).

Как инвестировать - Source on-air.ffin.kz

Question 1: What is Euribor and how is it determined?

Euribor stands for Euro Interbank Offered Rate and is a benchmark interest rate that represents the average interest rate at which major banks in the Eurozone lend money to each other. It is calculated daily by the European Money Markets Institute (EMMI) based on submissions from a panel of around 18 banks.

Question 2: Why is Euribor important?

Euribor serves as a reference rate for various financial instruments, including floating-rate loans, bonds, and derivatives. It influences the cost of borrowing for businesses and consumers, making it a key indicator of the overall health of the Eurozone economy.

Question 3: Are there different types of Euribor rates?

Yes, there are several Euribor rates, each representing a different maturity period. The most commonly used are the overnight rate (Euribor 1M) and the one-year rate (Euribor 12M).

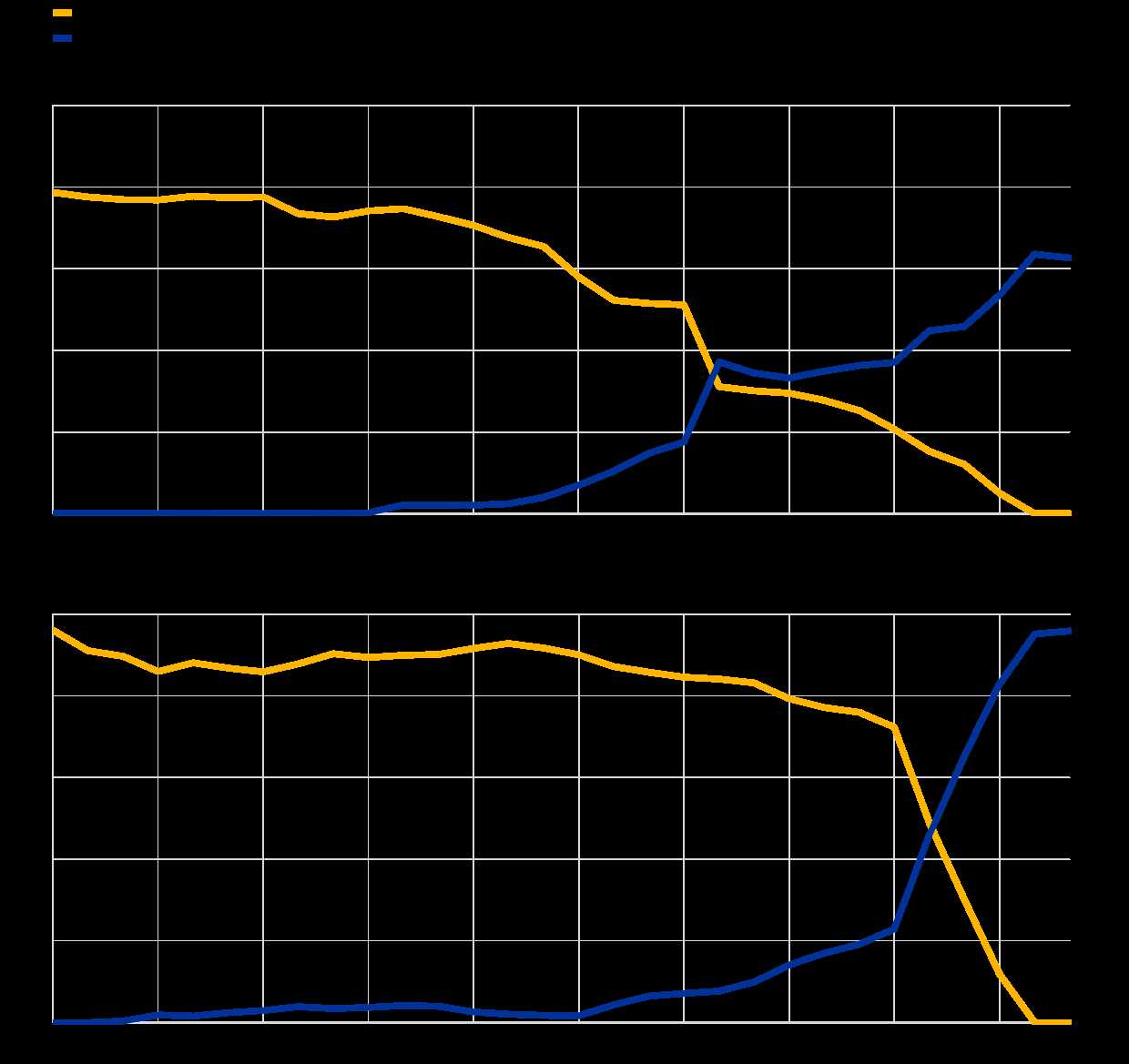

Question 4: How has Euribor been affected by recent economic events?

Euribor has been influenced by the COVID-19 pandemic and the European Central Bank's monetary policy decisions. In recent years, it has remained low due to the ECB's expansionary measures.

Question 5: What are the potential risks associated with using Euribor?

While Euribor is a widely accepted benchmark, it is not immune to manipulation or external factors. Its accuracy and reliability depend on the integrity of the participating banks and the regulatory framework.

Question 6: What is the future outlook for Euribor?

The future path of Euribor will depend on the economic conditions in the Eurozone and the monetary policy decisions of the ECB. Central bank communication and market expectations will continue to shape its trajectory.

Understanding Euribor and its implications is crucial for individuals and businesses involved in financial markets. By staying informed about the latest trends and developments, one can make informed decisions and mitigate potential risks.

Continue reading to explore other aspects of the Euro Interbank Offered Rate in the subsequent sections.

Tips: Unveiling The Euribor - A Comprehensive Guide To The Euro Interbank Offered Rate

The Euro Interbank Offered Rate (Euribor) plays a crucial role in the financial markets, impacting interest rates and economic decisions. Unveiling The Euribor: A Comprehensive Guide To The Euro Interbank Offered Rate, provides in-depth insights into this complex benchmark. Here are some key tips to enhance your understanding:

Tip 1: Historical Significance

Euribor evolved from its predecessor, the Brussels Interbank Offered Rate (Bribore), in 1999 with the introduction of the euro currency. Its purpose was to provide a standardized reference rate for interbank lending within the eurozone.

Tip 2: Calculation and Publication

The Euribor is calculated daily by the European Money Markets Institute (EMMI). It is based on a panel of leading banks in the eurozone that report their estimated borrowing rates for different maturities, ranging from overnight to 12 months.

Tip 3: Impact on Interest Rates

Euribor serves as a benchmark for interest rates on a wide range of financial products, including loans, mortgages, and bonds. It influences the cost of borrowing for businesses and individuals, thereby affecting economic activity.

Tip 4: Eurozone Monetary Policy

Euribor is closely monitored by the European Central Bank (ECB), which uses it as a key indicator of interbank lending conditions. The ECB's monetary policy decisions, such as setting interest rates, are influenced by Euribor fluctuations.

Tip 5: Global Financial Impact

Euribor, as a benchmark for the eurozone, has a global reach. It is used in international financial transactions and can influence interest rates in other currencies, impacting global economic conditions.

By understanding these tips, you gain a deeper appreciation of the Euribor's multifaceted role in the financial markets. For further exploration, Unveiling The Euribor: A Comprehensive Guide To The Euro Interbank Offered Rate provides a comprehensive analysis, empowering you to navigate the complex world of interbank interest rates.

Unveiling The Euribor: A Comprehensive Guide To The Euro Interbank Offered Rate

The Euro Interbank Offered Rate (Euribor) holds immense significance in the financial realm, impacting a wide range of economic activities. This comprehensive guide delves into six key aspects to unveil the nuances of this benchmark rate.

- Definition: Benchmark interest rate for interbank lending.

- Calculation: Daily average of lending rates among Eurozone banks.

- Maturities: Offered for a range of maturities from overnight to one year.

- Importance: Influences borrowing costs for businesses and consumers.

- Manipulation: Historically faced allegations of manipulation.

- Alternatives: Other interbank offered rates exist, such as LIBOR.

The Euribor serves as a crucial indicator of interbank lending conditions and affects financial markets globally. It plays a pivotal role in determining interest rates on loans, mortgages, and other financial products. Understanding its intricacies empowers individuals and institutions to make informed financial decisions. Moreover, recognizing the potential for manipulation and considering alternatives provides a comprehensive understanding of the Euro Interbank Offered Rate.

Was ist der EURIBOR? ++ Definition & Erklärung | Trading.de - Source trading.de

Unveiling The Euribor: A Comprehensive Guide To The Euro Interbank Offered Rate

The Euro Interbank Offered Rate (Euribor) is a benchmark interest rate that serves as a reference for short-term lending between banks within the Eurozone. This guide provides a comprehensive overview of the Euribor, exploring its history, calculation methodology, and significance in the financial markets.

Euro Interbank Offer Rate (Euribor) Definition, Uses, Vs. Eonia - SAXA fund - Source saxafund.org

The Euribor is calculated daily by the European Money Markets Institute (EMMI) based on submissions from a panel of leading banks. The rate represents the average interest rate at which these banks are willing to lend to each other for various maturities, ranging from overnight to 12 months.

The Euribor plays a crucial role in the financial markets. It serves as a benchmark for pricing various financial instruments, including loans, bonds, and derivatives. It also influences the cost of borrowing for businesses and individuals, impacting economic activity and monetary policy.

Significance of the Euribor

- Provides a benchmark for pricing financial instruments

- Influences the cost of borrowing for businesses and individuals

- Serves as a tool for monetary policy implementation

- Facilitates cross-border financial transactions

Challenges and Future Outlook

- Fluctuations in the Euribor can impact the stability of the financial system

- Regulatory changes may affect the calculation and use of the Euribor

- Alternative reference rates are being developed to address potential risks

Conclusion

The Euribor remains a critical benchmark in the Eurozone financial markets. Understanding its calculation, significance, and challenges provides valuable insights for market participants, policymakers, and financial analysts.

As the financial landscape evolves, it is essential to monitor developments related to the Euribor and adapt to regulatory changes and alternative reference rates to ensure the stability and efficiency of the financial system.