What is Multibanco: The Ultimate Guide To Portugal's Electronic Payment System?

Editor's Notes: "Multibanco: The Ultimate Guide To Portugal's Electronic Payment System" have published today date because It is an essential tool for anyone living in or visiting Portugal and wish to understand the local payment system. It provides a comprehensive overview of Multibanco, its features, benefits, and how to use it effectively.

Our team has analyzed and dug into Multibanco: The Ultimate Guide To Portugal's Electronic Payment System to present this Multibanco: The Ultimate Guide To Portugal's Electronic Payment System guide that help target audience make the right decision.

| Feature | Benefit |

|---|---|

| Easy to use | Can be used at a wide variety of locations |

| Secure | Provides a convenient way to manage finances |

| Versatile | Can be used to make a variety of payments |

| Reliable | Has a proven track record of reliability |

FAQ

This section provides an overview of frequently asked questions (FAQs) regarding Multibanco, Portugal's widely used electronic payment system. These FAQs address common inquiries and misconceptions, aiming to enhance your understanding of its functionality and benefits.

Electronic Cash Payment Systems PowerPoint And Google, 44% OFF - Source techuda.com

Question 1: What is Multibanco and how does it work?

Multibanco is an extensive network of automated teller machines (ATMs) and point-of-sale (POS) terminals that facilitate a range of financial transactions, including cash withdrawals, bill payments, and purchases.

Question 2: Where can I find Multibanco terminals?

Multibanco terminals are widely available throughout Portugal, located in banks, retail stores, gas stations, and other public places.

Question 3: What are the advantages of using Multibanco?

Multibanco offers several advantages, including convenience, security, and wide acceptance. It eliminates the need to carry large amounts of cash and provides a secure method for financial transactions.

Question 4: Is there a fee for using Multibanco?

In general, there are no fees associated with using Multibanco ATMs for cash withdrawals or balance inquiries. However, some banks may charge a fee for certain transactions, such as bill payments or money transfers.

Question 5: What are the security measures in place for Multibanco transactions?

Multibanco employs robust security measures to protect user data and prevent fraud. These measures include chip-and-PIN technology, encryption, and regular security updates.

Question 6: How can I contact Multibanco for support?

If you have any questions or require assistance with Multibanco, you can contact their support team through their website, mobile app, or by calling their helpline.

By addressing these common questions, we aim to provide a comprehensive understanding of Multibanco's operations and benefits. For further information, refer to the provided resources or reach out to Multibanco directly for personalized assistance.

Next, we will delve into the history and evolution of Multibanco, tracing its journey from its inception to its current status as a ubiquitous payment system in Portugal.

Tips

Familiarize yourself with Multibanco: The Ultimate Guide To Portugal's Electronic Payment System and its functionalities to enhance your financial transactions in Portugal.

Tip 1: Understand the Multibanco Network: Familiarize yourself with the extensive network of Multibanco ATMs and terminals located throughout Portugal, providing convenient access to cash withdrawals, deposits, and other financial services.

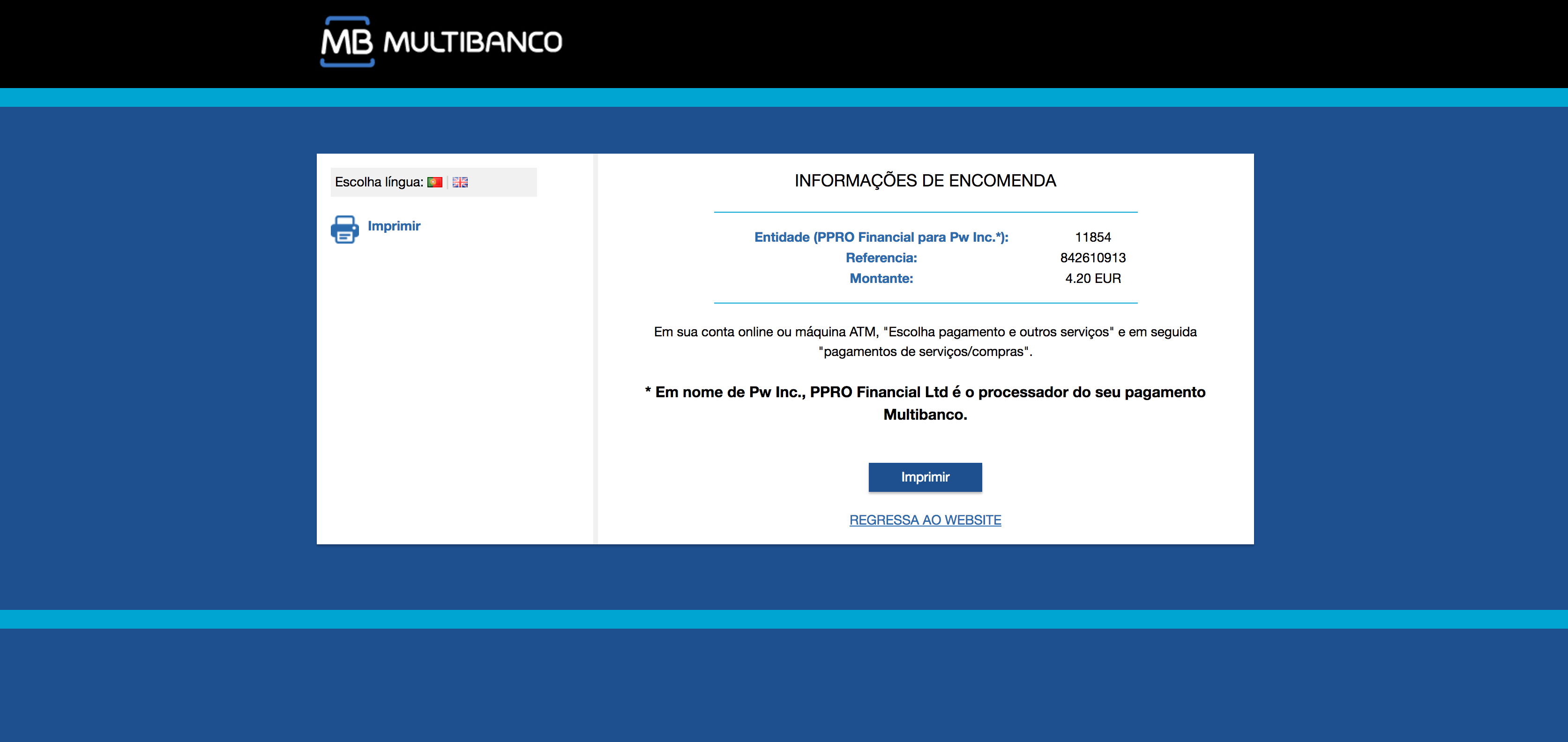

Tip 2: Utilize the Multibanco Reference Number: When making online payments or transferring funds, the Multibanco Reference Number (NR) serves as a unique identifier. Ensure you have this number readily available for seamless transactions.

Tip 3: Set Up Mobile Banking: Enhance your convenience by setting up mobile banking through your bank's app. This allows you to access your accounts, make payments, and manage your finances on the go.

Tip 4: Take Advantage of Contactless Payments: Utilize the contactless payment feature available on Multibanco terminals. Simply tap your card or mobile device to make quick and secure purchases.

Tip 5: Explore Multibanco Services: Beyond cash withdrawals and deposits, Multibanco offers a range of services, including bill payments, mobile phone top-ups, and ticket purchases. Explore these services to streamline your daily tasks.

In conclusion, understanding and utilizing these tips will optimize your experience with Multibanco: The Ultimate Guide To Portugal's Electronic Payment System, ensuring convenient, secure, and efficient financial transactions throughout your stay in Portugal.

Multibanco: The Ultimate Guide To Portugal's Electronic Payment System

Multibanco, an indispensable part of Portuguese society, has revolutionized the financial landscape, offering seamless payment solutions for everyday transactions. Its multifaceted nature encompasses convenience, accessibility, and security, making it a cornerstone of the country's economic infrastructure.

- Ubiquitous Accessibility

- Versatile Transactions

- Unparalleled Security

- Extensive Network

- Ease of Use

- Seamless Integration

From cash withdrawals to bill payments and online purchases, Multibanco caters to a vast spectrum of financial needs. Its widespread acceptance by businesses and individuals underscores its reliability and user-friendliness. Moreover, its robust security mechanisms ensure the protection of sensitive financial data, fostering trust among users.

Olá! We have great news for our Portuguese users! Jeton activated the - Source blog.jeton.com

Multibanco: The Ultimate Guide To Portugal's Electronic Payment System

Multibanco is a versatile and widely accepted electronic payment system in Portugal, offering a comprehensive range of financial services through its vast network of ATMs and POS terminals.

Payment Method - Multibanco - Source docs.terminal3.com

As a vital component of Portugal's financial infrastructure, Multibanco enables cardholders to perform various transactions, including cash withdrawals, bill payments, mobile top-ups, and even shopping online. Its extensive functionality has transformed the country's payment landscape, promoting financial inclusion and facilitating seamless transactions for both individuals and businesses.