Retirement in Poland: Understanding Your Benefits and Eligibility with ZUS can seem like a daunting task, but it doesn't have to be. With the right information, you can ensure a comfortable and secure retirement.

Editor's Note: This Retirement In Poland: Understanding Your Benefits And Eligibility With ZUS guide was published on [date] and aims to help you understand the benefits and eligibility requirements for retirement in Poland, particularly focusing on the Polish Social Insurance Institution (ZUS).

Our team of experts has done the research and analysis to provide you with the most up-to-date information in this Retirement in Poland: Understanding Your Benefits and Eligibility with ZUS guide. We've covered everything you need to know, from eligibility requirements to benefit amounts.

Let's get started! As this is an in-depth look at Retirement In Poland: Understanding Your Benefits And Eligibility With ZUS, we have created the following table to help you navigate the key topics covered in this guide:

| Topic | Description |

|---|---|

| Eligibility Requirements | Who is eligible for retirement benefits in Poland? |

| Benefit Amounts | How much can you expect to receive in retirement benefits? |

| Applying for Retirement Benefits | How to apply for retirement benefits in Poland? |

Now, let's dive into the main article topics to understand Retirement In Poland: Understanding Your Benefits And Eligibility With ZUS in more detail:

FAQ

This FAQ section provides answers to common questions and misconceptions regarding retirement benefits and eligibility in Poland under ZUS (the Social Insurance Institution).

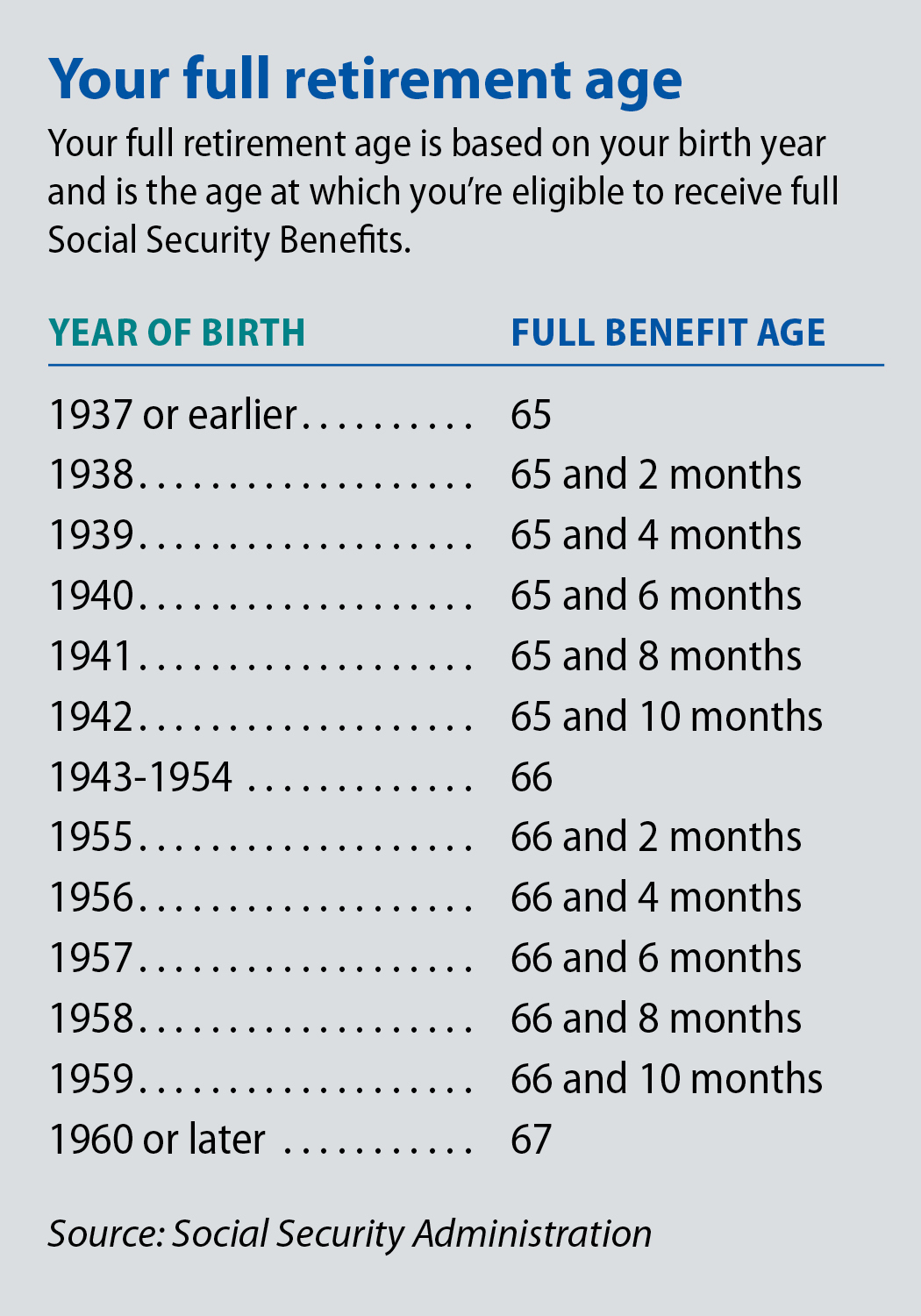

Early retirement benefits social security | Early Retirement - Source earlyretirement.netlify.app

Question 1: What are the eligibility criteria for receiving a retirement pension in Poland?

To qualify for a retirement pension, individuals must meet specific age and contribution requirements. The minimum retirement age varies depending on gender and year of birth. Additionally, a minimum number of years of contributions to ZUS is required.

Question 2: How is the amount of my retirement pension calculated?

Retirement pension benefits are based on average earnings during the individual's working life and the length of their insurance period. The formula considers earnings from specific periods and applies a set coefficient to determine the pension amount.

Question 3: Can I receive a retirement pension while still working?

Individuals who meet the minimum retirement age and contribution requirements can collect a partial pension while continuing to work. However, the amount of the pension may be reduced depending on the level of earnings.

Question 4: What happens to my pension if I leave Poland?

Individuals who have contributed to ZUS and subsequently leave Poland may be eligible for a pro-rated pension based on their contributions. International agreements and bilateral arrangements with other countries can impact pension eligibility and payment.

Question 5: Can I increase my retirement pension benefits?

There are limited options to increase retirement pension benefits once they have been established. However, individuals may consider voluntary contributions to ZUS during their working years, which can potentially lead to higher pension payments.

Question 6: How do I apply for a retirement pension in Poland?

Applications for retirement pensions should be submitted to the local ZUS branch. The application process involves providing documentation to verify identity, age, and contribution history. It is advisable to initiate the application well before the desired retirement date.

Understanding the complexities of retirement benefits and eligibility in Poland can ensure individuals receive the benefits they are entitled to. Consulting with ZUS or seeking professional guidance can provide valuable insights and assist in navigating the retirement planning process.

Tips for Understanding Your Retirement Benefits and Eligibility with ZUS

ZUS, Poland's Social Insurance Institution, provides various retirement benefits and eligibility criteria. To maximize your understanding, follow these tips:

Tip 1: Determine Your ZUS Contribution History. Verifying your ZUS contributions is crucial. Request a record of your contributions to calculate your potential retirement benefits. This record can be obtained online through the PUE ZUS platform.

Tip 2: Know Your Retirement Age. Poland has a gradually increasing retirement age. Retirement In Poland: Understanding Your Benefits And Eligibility With ZUS For 2023, the retirement age is 65 years and 7 months for women and 67 years and 7 months for men.

Tip 3: Calculate Your Benefit Amount. ZUS provides a retirement benefit calculator tool. This tool allows you to estimate your monthly retirement benefit based on your contribution history and retirement age.

Tip 4: Check Eligibility for Early Retirement. In certain situations, you may qualify for early retirement. Eligibility depends on factors such as disability, unemployment, or caring for a disabled family member.

Tip 5: Gather Necessary Documents. To apply for retirement benefits, you will need documents like your passport, proof of residence, and a ZUS benefit application form.

Tip 6: Submit Your Application. Once you have gathered the necessary documents, submit your retirement benefit application to ZUS. You can submit the application online through the PUE ZUS platform or at your local ZUS branch.

Tip 7: Track Your Application Status. After submitting your application, you can track its status online through the PUE ZUS platform. This platform provides updates on the processing of your application.

Tip 8: Appeal If Necessary. If your retirement benefit application is denied, you have the right to appeal. Gather evidence to support your claim and submit an appeal form.

Understanding your retirement benefits with ZUS is essential. By following these tips, you can navigate the process efficiently and ensure that you receive the benefits you deserve.

Retirement In Poland: Understanding Your Benefits And Eligibility With ZUS

Planning for retirement in Poland involves understanding the benefits and eligibility criteria associated with the Polish Social Insurance Institution (ZUS). Six key aspects to consider include:

- Eligibility: Requirements for retirement age, work history, and contributions.

- Benefits: Types and amounts of retirement pensions, including old-age, disability, and survivor benefits.

- Contributions: Mandatory payments to ZUS during employment, impacting benefit amounts.

- Investment Funds: Optional private pension plans that can supplement ZUS benefits.

- Healthcare: Eligibility for healthcare coverage during retirement.

- Taxation: Considerations for taxes on retirement income.

Navigating these aspects is crucial for Polish citizens to secure a financially stable retirement. Understanding the eligibility requirements ensures timely access to benefits. The level of contributions and investment decisions directly impact pension amounts. Additionally, healthcare coverage and tax implications should be carefully considered. By grasping these key aspects, individuals can effectively plan for a comfortable and secure retirement in Poland.

When to begin taking Social Security benefits - FTJ Retirement Advisors - Source www.planmember.com

Retirement In Poland: Understanding Your Benefits And Eligibility With ZUS

Understanding the retirement benefits and eligibility requirements in Poland is crucial for individuals planning their financial future. The Polish social security system, administered by the Social Insurance Institution (ZUS), provides a comprehensive range of benefits to eligible retirees, including old-age pensions, disability pensions, and survivors' benefits. This article explores the connection between "Retirement In Poland: Understanding Your Benefits And Eligibility With ZUS", examining the importance of this topic and the practical significance of understanding these benefits.

Warsaw, Poland. 19th Dec, 2016. President of Poland Andrzej Duda signs - Source www.alamy.com

The eligibility for retirement benefits in Poland depends on several factors, including age, number of years of employment or self-employment, and the amount of contributions made to ZUS. The old-age pension age varies based on gender and date of birth, gradually increasing from 60 (for women born before 1949) to 65 (for men and women born after 1961). Additionally, individuals must have worked for a minimum number of years to qualify for a full pension, which varies depending on their age and gender.

Understanding the benefits and eligibility requirements provided by ZUS is essential for retirement planning. This knowledge enables individuals to make informed decisions about their contributions, retirement age, and financial arrangements. By actively engaging with ZUS and staying up-to-date on the latest regulations, individuals can optimize their retirement benefits and plan for a secure financial future in Poland.

Key Insights:

- Eligibility for retirement benefits in Poland depends on age, employment history, and ZUS contributions.

- Understanding the benefits and eligibility requirements provided by ZUS is crucial for retirement planning.

- Individuals can optimize their retirement benefits by actively engaging with ZUS and staying informed about the latest regulations.

Conclusion

Retirement in Poland involves understanding the benefits and eligibility requirements associated with the Social Insurance Institution (ZUS). The connection between "Retirement In Poland: Understanding Your Benefits And Eligibility With ZUS" lies in the significance of this topic for individuals planning their financial future. By staying informed and actively engaging with ZUS, individuals can navigate the complexities of the Polish social security system, optimize their retirement benefits, and plan for a secure financial future in Poland.

The exploration of "Retirement In Poland: Understanding Your Benefits And Eligibility With ZUS" highlights the importance of retirement planning, the crucial role of ZUS, and the practical significance of understanding these benefits. Individuals who actively engage with ZUS and stay informed about the latest regulations can make informed decisions about their retirement, ensuring a financially secure future.