All about Retirement Pensions in Poland – A Comprehensive Guide

Company Registration in Gdansk, Poland in 2024-25: Eligibility & Benefits - Source ondemandint.com

Editor's Notes: "The Ultimate Guide To Statutory Retirement Pensions In Poland: Eligibility, Benefits, And Application" have published on March 8, 2023. Your retirement pension is one of the most important financial decisions you'll make, so it's important to understand all of your options before you make a decision. This guide will provide you with all the information you need to know about statutory retirement pensions in Poland, including eligibility, benefits, and how to apply.

In this guide, we'll cover everything you need to know about statutory retirement pensions in Poland, including:

- Who is eligible for a statutory retirement pension?

- What are the benefits of a statutory retirement pension?

- How to apply for a statutory retirement pension?

So whether you're just starting to think about retirement or you're already in the process of applying for a pension, this guide has everything you need to know.

FAQ

This comprehensive guide provides an overview of questions commonly asked concerning statutory retirement pensions in Poland, addressing eligibility criteria, types of benefits available, and the application process.

Vested: Qualifying for a Retirement Benefit - New York Retirement News - Source nyretirementnews.com

Question 1: Am I eligible for a statutory retirement pension in Poland?

Eligibility for a statutory retirement pension is determined by meeting specific age and contribution requirements. The standard retirement age is currently 60 for women and 65 for men. However, individuals who have contributed to the Polish social security system for at least 20 years may retire earlier.

Question 2: What types of benefits are included in a statutory retirement pension?

Statutory retirement pensions consist of two main components: the basic pension and the additional pension. The basic pension is a flat-rate amount determined by the number of years of contributions. The additional pension is based on an individual's average earnings during their working life.

Question 3: How do I apply for a statutory retirement pension?

To apply for a statutory retirement pension, individuals must submit an application to the Social Insurance Institution (ZUS). The application can be made online, by mail, or in person at a local ZUS office. The necessary documents include proof of age, proof of contributions, and a bank account statement.

Question 4: What is the average amount of a statutory retirement pension in Poland?

The average amount of a statutory retirement pension in Poland varies depending on factors such as the number of years of contributions and the individual's average earnings. In 2023, the average monthly retirement pension was approximately 2,500 PLN (approximately 550 EUR).

Question 5: Can I receive a statutory retirement pension while working?

Individuals who meet the age and contribution requirements can receive a statutory retirement pension while continuing to work. However, their pension may be reduced by a certain percentage depending on the amount of income they earn from employment.

Question 6: What are the consequences of retiring early?

Individuals who choose to retire before reaching the standard retirement age will receive a reduced pension. The amount of the reduction is based on the number of months remaining until the standard retirement age.

This guide provides a general overview of statutory retirement pensions in Poland. For more detailed information and personalized advice, it is recommended to consult with a financial advisor or the Social Insurance Institution (ZUS).

Continue to the next section to explore other important aspects of retirement planning in Poland.

Tips

Stay informed about the latest regulations and changes related to statutory retirement pensions in Poland by visiting the Social Insurance Institution (ZUS) website and consulting with pension experts or advisors.

Tip 1: Plan your retirement early.

This involves estimating your future pension amount based on your contributions and earnings history, as well as considering other sources of retirement income, such as private pensions or savings.

Tip 2: Maximize your pension contributions.

Ensure you make regular and sufficient contributions to your pension scheme throughout your working life. Voluntary contributions can also increase your future pension benefits.

Tip 3: Meet the eligibility requirements.

Verify that you meet the minimum age and contribution period requirements to qualify for a statutory retirement pension. For more information, refer to The Ultimate Guide To Statutory Retirement Pensions In Poland: Eligibility, Benefits, And Application.

Tip 4: Apply for your pension on time.

Submit your pension application to ZUS well before your desired retirement date to avoid any delays in receiving your benefits.

Tip 5: Appeal denied applications.

If your pension application is denied, you have the right to appeal the decision. Consult with a legal professional or a pension advisor to assist you with the appeal process.

By following these tips, you can ensure that you receive the full benefits of your statutory retirement pension in Poland.

Why pensions engagement can’t wait for your retirement | Bectu - Source bectu.org.uk

The Ultimate Guide To Statutory Retirement Pensions In Poland: Eligibility, Benefits, And Application

Statutory retirement pensions in Poland are a crucial aspect of the social security system, providing financial support to individuals upon reaching retirement age. Understanding the eligibility criteria, benefits, and application process is essential for planning a secure financial future.

- Eligibility: Age and contribution requirements.

- Benefits: Monthly pension payments, based on earnings and contribution history.

- Application: Submitting the necessary documentation to the Social Insurance Institution (ZUS).

- Early Retirement: Available under certain conditions, but may result in reduced benefits.

- Disability Pensions: Provided to individuals with severe disabilities, regardless of age.

- Survivor Benefits: Pensions or lump sums paid to surviving spouses or dependents.

Understanding these key aspects is crucial for individuals planning for retirement. Meeting eligibility requirements, maximizing benefits, and navigating the application process ensures a smooth transition into post-employment life. For example, individuals with long contribution histories and higher earnings will generally receive higher pension benefits. Additionally, early retirement can provide flexibility but requires careful consideration of the potential financial implications.

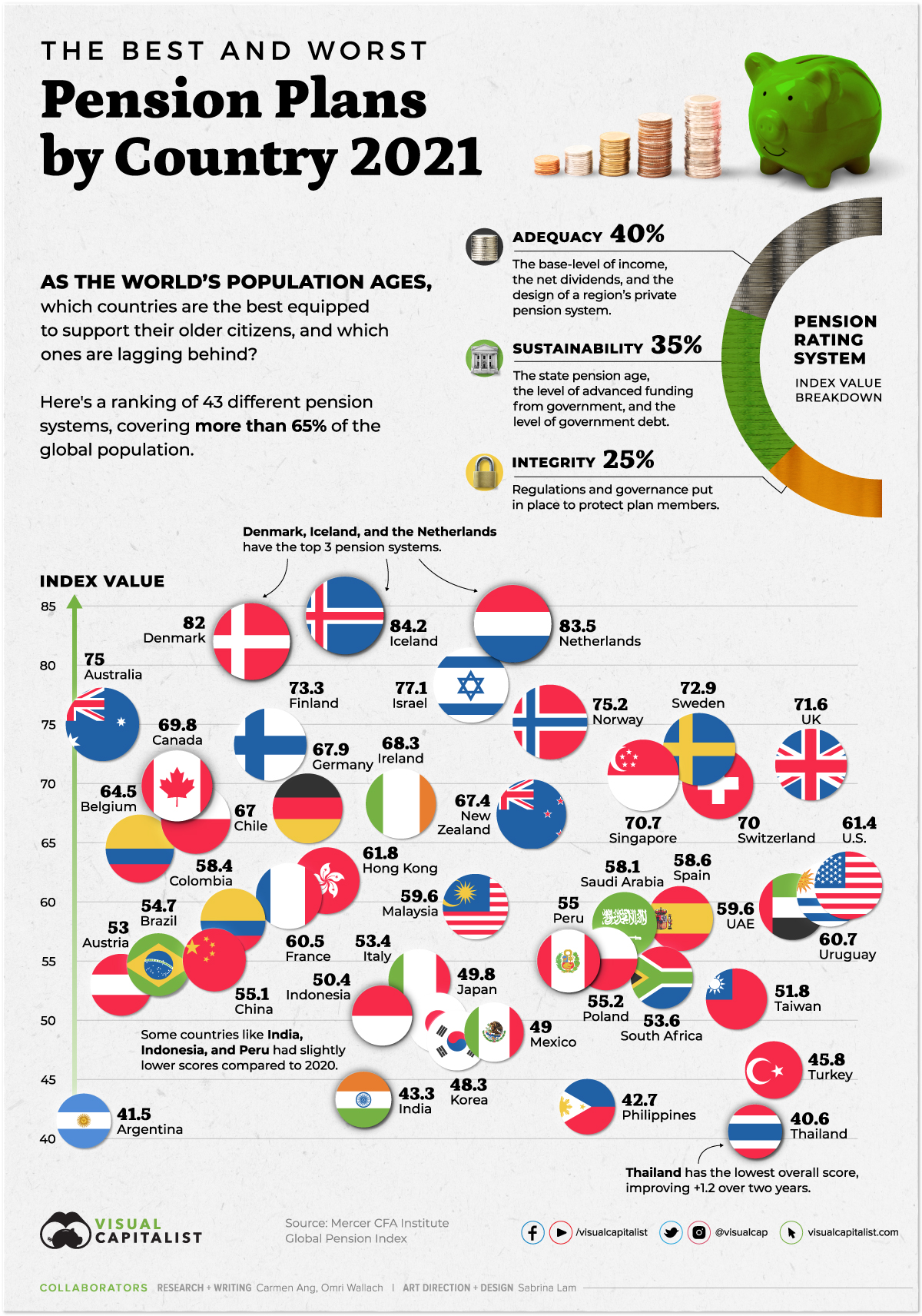

Ranked: The Best and Worst Pension Plans, by Country - Source www.visualcapitalist.com

The Ultimate Guide To Statutory Retirement Pensions In Poland: Eligibility, Benefits, And Application

The Ultimate Guide To Statutory Retirement Pensions In Poland: Eligibility, Benefits, And Application provides a comprehensive overview of the Polish statutory retirement pension system. It explains the eligibility criteria, benefit calculation methods, and application procedures for various types of retirement pensions, including old-age, disability, and survivors' pensions. This guide is an essential resource for individuals who are planning for their retirement or who have questions about their pension entitlements in Poland.

Decoding Pensions: Your Complete Guide to Retirement Income - Source financefloat.com

Understanding the statutory retirement pension system in Poland is crucial for several reasons. First, it provides individuals with a secure source of income during their retirement years. Second, it helps individuals plan for their financial future and make informed decisions about their savings and investments. Third, it ensures that individuals have access to essential services and support during their retirement, such as healthcare and long-term care.

The Polish statutory retirement pension system is a complex and multifaceted topic. However, by gaining a comprehensive understanding of its eligibility criteria, benefit calculation methods, and application procedures, individuals can ensure that they are receiving the full benefits to which they are entitled. This guide provides a valuable resource for individuals who are seeking to maximize their retirement income and secure their financial future.

Table: Key Insights on Statutory Retirement Pensions in Poland

| Eligibility | Benefits | Application |

|---|---|---|

| Age, work history, and contributions | Old-age, disability, and survivors' pensions | Online, by mail, or in person |

Conclusion

The Ultimate Guide To Statutory Retirement Pensions In Poland: Eligibility, Benefits, And Application provides a comprehensive overview of the Polish statutory retirement pension system. It explains the eligibility criteria, benefit calculation methods, and application procedures for various types of retirement pensions, including old-age, disability, and survivors' pensions. This guide is an essential resource for individuals who are planning for their retirement or who have questions about their pension entitlements in Poland.

Understanding the statutory retirement pension system in Poland is crucial for several reasons. First, it provides individuals with a secure source of income during their retirement years. Second, it helps individuals plan for their financial future and make informed decisions about their savings and investments. Third, it ensures that individuals have access to essential services and support during their retirement, such as healthcare and long-term care.